Why is Philip Morris trading like a tech stock?

Last week I published a short piece about the current macro dynamics and explained why I’m hesitant to invest in equity at the moment, which I believe makes this is the best time to sit down and update my watchlist in order to be ready when better prices will emerge.

I was initially thinking about publishing a single article with a short thesis for each stock, but soon realized it would be extremely reductive and yet still risk being extremely long since there are several industries and around 30 stocks that I follow closely.

So I decided to break it down and present different theses, either by theme (as the one on tobacco you are reading below) or focus on a certain stock (such as I’ve done in the past for Match Group here and here) when it’s something that requires an individual analysis.

For the sake of getting to the point, I will not expand on the history of each company and will for the most part assume readers have at least a basic understanding of the sector and business dynamics.

Introduction

It is a well-known fact by now that consumption of cigarettes is on the decline among all age groups. Younger generations are more health-conscious about the risk of smoking, and this has contributed to the steady decrease in the volume of combustible products (i.e. cigarettes).

Based on this, one might posit that tobacco firms are doomed.

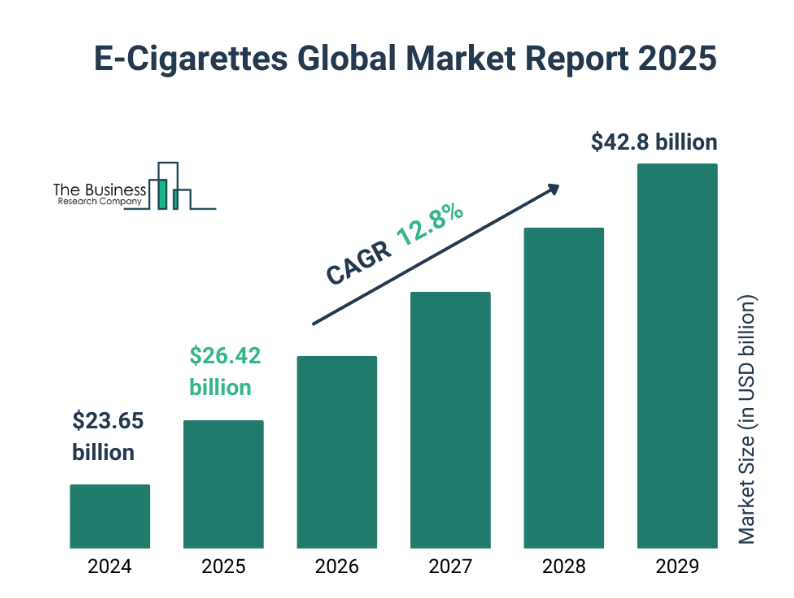

However, if one looks at the total tobacco market – thus including smokeless products such as vapes, pouches and heat-not-burn sticks – the picture is quite different.

So, what is contributing to the net positive trend in the industry? While tobacco firms have known for ages about the shifting preferences among consumers, as well as the increasing regulation and scrutiny from public health officials, they have also played defence and invested billions in the transition towards smokeless products, which are essentially three:

- Oral nicotine pouches (such as ZYN, Velo and on!)

- Electronic cigarettes (a.k.a vapes)

- Heat-not-burn sticks (such as IQOS and Ploom)

N.B. It should be noted that the U.S. e-vapor market is plagued by illicit, flavored disposable products (mostly from China), with illegal disposable vaping devices having garnered 70% of the market in the US. It’s possible that the prediction above is underestimated.

Nicotine’s addictive properties make demand for tobacco products inelastic, and as such one may posit that this will allow tobacco companies to ride out a potential recession (i.e. consumers will continue to buy their products regardless of how well the economy is doing). Nevertheless, the trends away from cigarettes and towards smokeless products will require hefty investments, and it is starting to get clear by now who may be the likely winner in this race (spoiler alert: Philip Morris).

Another assumption that I had when I decided to start this research is that tobacco companies are the best positioned to profit from the deregulation of cannabis that is increasingly happening, especially across the United States.

Therefore, in this article I will look at some companies in the space, with a focus on:

1. how they are managing the transition towards smokeless products

2. their investments in cannabis-related businesses

Finally, looking at Philip Morris P/E of 27 I asked myself “why is this company trading like a tech stock?!?”

The goal of this article is to investigate that.

Altria ($MO)

Cigarette volumes are in sharp decrease across all brands. It’s a dying product. Nevertheless, it is still a huge cash cow, while pouches, vapes, and heated products are the growth engines (with regulatory and competitive hurdles). All three firms are balancing defending the cigarette core with aggressively investing in smoke-free categories to secure their future, albeit with different results across the board.

I will not spend much time on the combustible business and simply highlight, for each brand, the pace of the decline.

For example, In Q1 2025 Altria’s smokeable product segment revenue declined -5.8% YoY while domestic (Altria operates only in the US market) cigarette shipment volume decreased by 13.7%.

Let’s now focus the attention on how Altria is trying to buck this trend through innovation, acquisitions and investments in the cannabis space. I will follow the same structure for British American Tobacco and Philip Morris.

Electronic cigarettes (i.e. vapes)

Altria acquired a 35% stake in Juul Labs on December 20, 2018. Back then, Juul was considered the most hyped up vape on the market. The deal involved a $12.8 billion investment, valuing Juul at $38 billion.

Soon after, Juul faced lawsuits from several states and cities, as well as tighter regulations from the FDA, the U.S. Food and Drug Administration.

The company eventually had to impair the stake, and the Juul fiasco ultimately lit $11.2 billion of Altria shareholder capital on fire.

In March 2023, Altria decided to revive its vaping ambitions by purchasing e-cigarette startup NJOY for $2.8B.

In July 2023, shortly after Altria divested its 35% stake in Juul, the latter filed complaints against Njoy alleging its Njoy Ace e-cigarette device infringed on several patents of Juul Labs. Altria subsidiary Njoy filed a similar complaint in 2023 against Juul Labs.

On Jan. 29 of this year, the International Trade Commission (ITC) issued a final determination that Altria’s Njoy Ace infringed all four patents that Juul Labs asserted against it, and issued orders prohibiting Altria and Njoy from importing and selling the infringing Ace until the patents expire in 2034 and 2037.

Altria Group has halted the sale of its NJOY Ace e-cigarette products in the United States, effective March 31, 2025.

The ruling marks a major setback for Altria’s e-vapor strategy just two years after acquiring NJOY. In Q1 2025 it recorded an impairment charge of $873M. The implications are significant: the NJOY Ace was not only the first pod-based vape to receive FDA marketing authorization, but also, as of June 2024, the only menthol-flavored e-cigarette product legally sold in the US. Its removal leaves a gap in a market that remains saturated by unauthorized disposable vapes, many of which are flavored and imported illicitly.

Now with NJOY Ace off shelves, Altria effectively has no vape revenue for the remainder of 2025. Altria is lobbying for FDA enforcement against illegal vapes, but until the market is cleaned up or NJOY develops a non-infringing device, Altria is largely absent from this high-growth segment.

Oral nicotine pouches

With regard to the oral nicotine pouches segment, Altria operates with several brands, the most famous of which are On! (100% tobacco-free) and Copenhagen (made with real tobacco leaves). While the industry as a whole is growing, Q1 Y/Y volumes are declining 5%. This decline was “primarily driven by retail share losses” – meaning consumers choosing competing pouch brands over Altria’s.

Heat-not-burn sticks

As of Q1 2025 no heated products are being sold by Altria.

In October 2022, Altria formed a joint venture with Japan Tobacco International (JTI) to develop and eventually commercialize JTI’s “Ploom” heated tobacco system in the US. The JV, named Horizon Innovations, is 75% owned by Altria and 25% by JTI. Its mission is to prepare for a U.S. launch of heated stick products once they can get FDA authorization.

So far, however, the FDA has not authorized any Ploom devices for sale, and the U.S. market remains effectively closed to heated products, with the exception of Philip Morris’ IQOS.

Cronos Stake

In March 2019, Altria made a headline-grabbing move into cannabis by investing USD $1.8 billion for a 45% stake in Cronos Group, a leading Canadian cannabinoid company. This deal, at the time, valued Cronos at almost $4 billion and was seen as Altria’s entry into the legal cannabis sector.

Recreational cannabis was legalized in Canada in 2018. The Canadian market quickly became oversupplied and hyper-competitive, leading to falling prices and struggles for most licensed producers.

A big part of Altria’s interest was the potential for U.S. federal cannabis legalization. The idea was Cronos could be Altria’s vehicle to enter the U.S. THC market if laws changed. However, federal legalization (or even banking reform) has stalled for years. Without access to the U.S. market, Cronos’s growth prospects were limited to Canada and a few international medical markets. This severely capped the upside that Altria might have envisioned.

At the time of writing, Cronos market cap is $717M, meaning Altria’s 45% stake is worth only ~$315 million. It’s now clear Altria overpaid for Cronos. $1.8B for 45% implied a huge premium given Cronos’s small revenue at the time (annual sales were under $15M in 2018).

British American Tobacco ($BTI)

In Q1 2025, British American Tobacco’s combustibles revenue remained relatively stable year-over-year, while global cigarette shipment volume declined by approximately 5–6%, driven by continued weakness in developed markets and the impact of its Russia market exit.

British American Tobacco’s Q1 2025 revenue was more geographically diversified than Altria’s, but by product segment it mirrors the industry trend: combustibles still deliver the bulk of sales and profit, while new categories (vapes, heated, oral) are growing fast (albeit off a smaller base). In FY2024, BAT’s combustibles segment was ca. 82.5% of revenue, and New Categories ca. 17.5%

While BAT is slowly working to revamp a mostly flat top line by shifting their focus on smokeless products, a 1% gain in share (17.5% from 16.5%) is too slow, especially considering that competitor Philip Morris is already at 42%.

This raises a red flag similar to Altria’s: will management be able to steer the ship towards smokeless products? While BAT’s product innovation team seems to be well-calibrated, their product portfolio seems to be plagued with regulatory constraints.

Oral nicotine pouches

In the oral space, Velo nicotine pouches are coming out as a strong challenger to Zyn (Philip Morris) with its U.S. market share reaching 7.9% in Q1 2025.

However, BAT is facing regulatory risks, particularly concerning its VELO Plus product, which uses synthetic nicotine. Although BAT met the FDA's 2022 deadline to submit a premarket tobacco product application (PMTA), allowing VELO Plus to remain on the market during the agency's review, ongoing FDA staffing issues have delayed any definitive ruling. A potential FDA ban on synthetic nicotine could severely impact BAT by eliminating VELO Plus from the U.S. market and ceding ground to competitors like Zyn.

E-cigarettes (vapes)

Vuse Alto remains the top-selling legal e-cig in the U.S. (with BAT holding 35–40% of U.S. measured vape market by value), but illicit competitors limit further share gains. BAT is addressing this by innovating: it is preparing to launch a new high-end device called Vuse Ultra in H2 2025.

BAT hinted that Ultra is meant to counter illicit disposables by offering an elevated experience that adult vapers will prefer. Expect a sleek design, long battery, and maybe multi-flavor pod compatibility (pending regulations). Essentially, Vuse Ultra is BAT’s innovation to attract users at the high end of the vape market who might be using flashy disposables.

Heat-not-burn sticks

In the heated tobacco space, BAT plans to roll out glo Hilo across Europe and Asia in H2 2025. BAT hopes its new Glo Hilo product can compete directly with Philip Morris’s popular IQOS ILUMA product.

ITC stake

It is worth mentioning that BAT owns a 22.9% stake in Indian conglomerate ITC (Imperial Tobacco Company of India), which is involved in several lines of business such as Tobacco, FMCG, paper products and packaging.

India has stringent restrictions on foreign direct investment in tobacco manufacturing, and by owning a stake in ITC (which dominates Indian cigarettes with brands like Gold Flake), BAT ensured it would benefit from India’s growth without violating local regulations. In essence, ITC has been an associate of BAT that delivers dividends and equity value from Indian tobacco profits, while BAT itself cannot operate there outright.

The stake also represents a “free option” to introduce new categories (like vaping or heated tobacco) in India when the government eventually allows them.

In 2023, BAT sold 2.5% of ITC via a block trade for ~$1.5 billion. The reason for selling was to unlock cash for debt reduction and share buybacks.

As of today, their stake is worth ca. $14 billion and, in theory, could be used to further repay 40% of their debt.

Organigram Stake

Between March 2021 and March 2023, BAT invested a total of CAD $221 million in Canadian cannabis company Organigram for an initial 19.9% equity stake, and then committed an additional CAD $124.6 million between 2023 and Q1 2025 to increase its ownership to about ~45% (on a fully diluted basis).

Originally the investment from BAT served as a strategic partnership aimed at leveraging both companies' expertise in product development and global expansion within the cannabis market.

In a recent earnings call, BAT’s management noted that “Organigram is not really a relevant capital deployment at this point. What we want to do is to create a foundation in the cannabis space without having to deploy massive capitals like other companies have done in order to be prepared in case the regulatory environment changes.”

While BAT’s management states that “Organigram is the best company out there in terms of management and capabilities”, shares of Organigram are down 24% YTD and 80% in the past five years. Like most Canadian cannabis companies, Organigram has faced oversupply, which has driven prices down and made profitability elusive.

However, Organigram has shown some bright spots: it has consistently been a top-3 player in Canada’s recreational market share. In its fiscal Q1 2023, Organigram actually achieved positive adjusted EBITDA (a rarity among cannabis firms).

BAT’s stake in Organigram mirrors Altria’s stake in Cronos (both around ~$1.8B valued investments at inception) but on a smaller scale (BAT invested the equivalent of $255 vs Altria’s $1.8B), which was wise given the sector downturn.

Philip Morris ($PM)

Philip Morris is the undisputed leader in the smoke-free segment, with a history of successful innovation and recent acquisitions that, unlike Altria, actually paid off. As a result, the share of smoke-free products in total revenue in 2024 was 39%, and revenue itself increased by almost 8%, a pretty unusual jump for a tobacco company. For comparison, the share of these products in 2022 was 32%. In Q1 2025, smoke-free products jumped to 42% of PMI’s total revenue: a 3pp gain in only 1 quarter speaks to the fact that PM is executing fast in its transition.

Oral nicotine pouches

The company gained control of ZYN brand after the purchase of the Swedish company Swedish Match in 2022. Today, the ZYN is a global leader in the nicotine pouch segment (65% volume share in the US).

Zyn has been in short supply due to its popularity with everyone from SEC fraternities to West Village influencers. Zyn products have been flying off the shelves so fast that the company announced in September 2024 that it plans on investing over $800 million in new production for the product in order to meet demand. Philip Morris received the seal of approval in January 2025, after the U.S. Food and Drug Administration authorized the marketing of the Zyn product.

While PM’s focus is on Zyn from this deal, integrating Swedish Match’s operations was a major project in 2023–2024. It instantly provided PM with a U.S. distribution infrastructure – a noteworthy development because PM had no U.S. sales force (Altria handled IQOS previously – see below).

E-cigarettes (vapes)

PM’s flagship vape product is IQOS VEEV, an e-vapor device available in some markets.

PMI hasn’t emphasized vaping as strongly (the company often notes the U.S. illicit vape situation as a deterrent), and it has positioned VEEV primarily in markets with tight regulatory regimes and clear premarket approval frameworks, avoiding jurisdictions where flavored disposables dominate illicitly (e.g., the U.S.).

Revenue contribution remains limited, likely below 5% of total net revenue (vape revenue is not broken out), but PMI sees it as a strategic platform for nicotine delivery in markets where heated tobacco is restricted or less popular.

Heat-not-burn sticks

Philip Morris was the first to invest in smoke-free technologies, launching the IQOS ILUMA tobacco heating system in 2014 and thus overtaking competitors BAT (GLO) and JTI (Ploom), which launched their products much later. This allowed PMI to occupy critical markets, such as Japan, where IQOS controls more than 31% of the heated tobacco segment. Globally, PMI had ~38.6 million IQOS users by Q1 2025 and heated products alone are roughly ~35% of revenue. In Japan, IQOS commands over 32% market share of the entire tobacco market (including cigarettes). In Europe, IQOS continues to gain ground, reaching 11.4% share of the total tobacco market across key countries like Italy, Germany, Greece.

IQOS heating sticks were briefly available in the U.S., sold by Altria under license from Philip Morris in a few pilot markets (e.g., Atlanta, Richmond). PMI regained exclusive rights to commercialize IQOS in the U.S. from Altria by buying out the license agreement for ~$2.7 billion. As of mid-2025, IQOS is not yet commercially available in the U.S., but a relaunch is expected soon, likely before the end of 2025. PMI will leverage Swedish Match’s U.S. infrastructure for distribution and expects this to be a major strategic market, especially as U.S. regulators seek alternatives to combustible cigarettes.

Cannabis investments

Philip Morris has been cautious and relatively quiet regarding direct cannabis investments, especially compared to Altria or BAT. This also highlights their sharp focus to become the category leader in the smoke-free segment.

Conclusion

Based on the above it seems like the clear winner is Philip Morris. However, at the time of writing Philip Morris trades more like a tech stock than a tobacco firm: forward P/E is equal to 25 (compared to a five-year average of 16.77). For reference, Altria currently trades at 11.24 and British American Tobacco at 10.69.

Why such a large premium?

1. by Q1 2025 PMI is getting 42% of revenue from smokeless products, versus 17–18% at BAT and 10–12% at Altria. This highlights PMI’s lead in transforming its portfolio, versus BAT and especially Altria which remain far more cigarette-dependent.

2. In Q1 of this year Philip Morris recorded almost unheard-of earnings growth for a tobacco company: earnings per share (EPS) rose almost 13% to $1.69, or 17% in constant currency. What is even more striking is the fact that PM invested ca. $2.2 billion in R&D and Capex in 2024, and still managed to increase EPS by a whopping 13%.

To put the numbers side by side (2024 figures):

PMI: ~$2.2 billion on R&D + CapEx ≈ 5.7% of revenue

BAT: ~$1.3 billion on R&D + CapEx ≈ 3.7% of revenue

Altria: ~$0.35 billion on R&D + CapEx ≈ 1.5% of revenue

Investing 5.7% of revenue in R&D+CapEx is a notably high commitment for a tobacco company. PMI’s heavy spend has gone into developing new devices (like IQOS ILUMA), upgrading manufacturing lines for heated tobacco units and pouches, and acquiring strategic brands (ZYN) and distribution capabilities for the next launches. The payoff is seen in PMI’s strong growth, even with 5.7% of revenue being reinvested, which demonstrates efficient use of that capital.

3. Altria’s investments were quite low compared to PMI and BAT, which underscores Altria’s strategy to buy innovation rather than build it in-house. Altria’s billion-dollar fiascos with JUUL, NJOY and Cronos make me unsure about Altria’s management’s ability to effectively shift their business to smokeless-products or to take advantage of any opportunity in the cannabis space.

4. BAT’s global footprint and solid cash flow give it the resources to catch up, but until regulatory clarity improves and execution accelerates, the company will likely remain a distant second to Philip Morris in smoke-free innovation.

Such differences in innovation investment help explain why PM is perceived as the technology leader among tobacco companies and trades at higher earnings multiples.

Unlike Altria (and to some extent BAT), PM’s management seems to know what they are doing.

As of this writing, Philip Morris stock has surged over 33% in 2025 alone and over 65% in the past year. It should be noted that this reflects not just IQOS and Zyn success, but also currency tailwinds (USD weakness is helping PM): in fact, while PM consolidates in dollars, it derives 100% of its business from outside the United States.

In short, Philip Morris is the premier long-term pick in tobacco, yet its current valuation calls for patience and a more attractive entry point before building a full position.

Disclaimer: This article is not financial advice. Always do your own research and due diligence before making any investment decisions.