Match Group's Market Mismatch

A Deep Dive into Payers Dynamics, Innovation Roadmap, and Capital Allocation

Table of Contents

Introduction

Match Group portfolio strategy

Q4 and Full Year 2023 Results

The TAM/payers Conundrum

Product innovation in a de facto duopoly and untapped opportunities

Management shakeup and Elliot stake

Capital allocation

Valuation

Conclusion

Summary

Match Group is the market leader in a de facto duopoly in the dating app market.

Despite a tough economic climate, the company is achieving double-digit top-line growth while maintaining robust margins.

Analysts’ focus on the number of payers overlooks Match Group's evolution into a new phase of its lifecycle.

Emerging legislation and legal actions against Apple and Google could lower fees, potentially boosting Match Group's margins significantly.

Trends in share repurchases to offset rising SBC are notable, but Elliott's activist involvement is expected to enforce more disciplined capital allocation.

Introduction

I believe humans are inherently designed to meet potential partners in real life - be it at a bar, a yoga class, or the supermarket, and not behind a screen while swiping left or right on an app. As humans, we have become extremely sensitive to rejection, which often makes it easier to search for love, intimacy, and sex on dating apps rather than risk embarrassment by asking someone out in person.

At the same time, there are many potential partners whom we could never possibly meet in real life if it weren’t for dating apps. In this sense, dating apps serve as an enabler for these connections to occur, and in an era where loneliness is at peak levels, this represents a potentially positive trend.

While there could be a debate about whether dating apps (within the larger context of social networks or even smartphones) are one of the determinants of heightened loneliness among people, they inevitably also provide value to what is a natural need of every human being: connecting with others, feeling loved, engaging in sexual activity, and potentially building a family with a partner.

Match Group Portfolio Strategy

My goal is not to repeat things that are addressed in most other articles about Match, but rather to get straight to the point of the relevant aspects. Therefore, I won’t spend much time elaborating on what Match Group does, particularly since their products are relatively straightforward to understand.

Nonetheless, I think it is important to spend a few words about their portfolio strategy, as it is relevant for later considerations on product innovation and capital allocation.

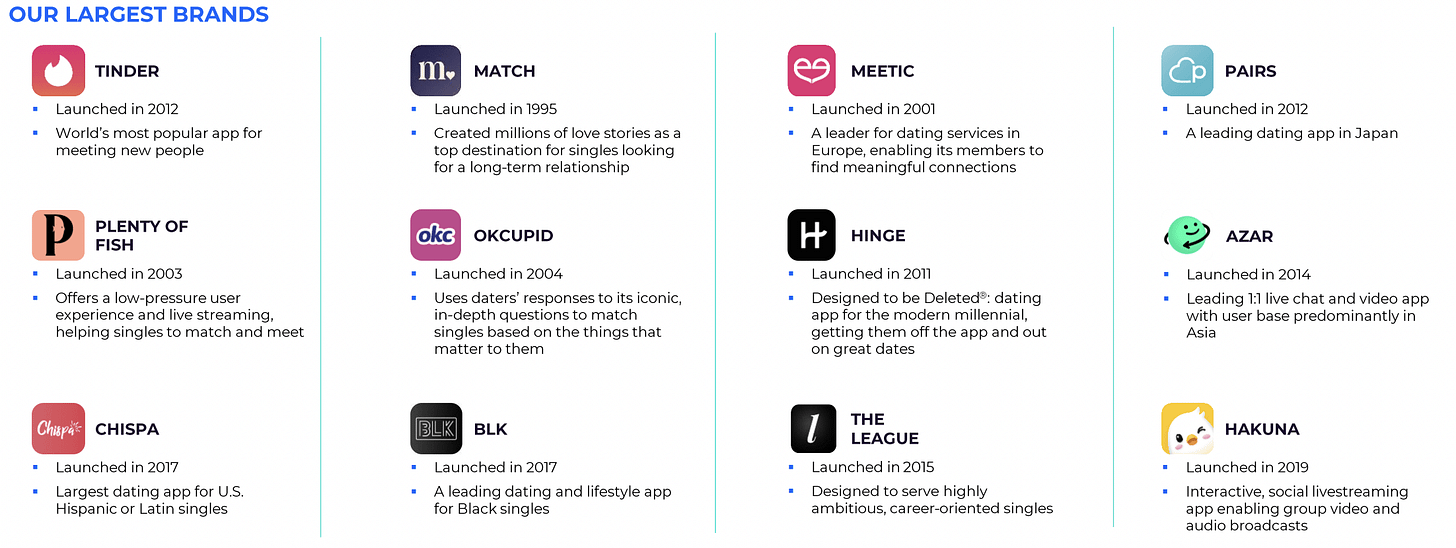

Match Group’s goal is to build digital technologies designed to help people make meaningful connections. The company currently operates 13 brands, ranging from the most popular Tinder and Hinge to the more recent acquisitions The League, Azar and Hakuna. These brands cater to a wide range of users, encompassing varied interests, goals, and demographics.

Note: the illustration below doesn’t include Archer, Match Group’s newest app, which caters specifically to gay men.

Source: Match Group Investor Relations

When Bernard Kim assumed the role of CEO in May 2022, he promptly restructured the company’s portfolio into four distinct groups:

Tinder: the largest brand in terms of revenue and cash generation.

Hinge: the fastest-growing brand in the portfolio.

Match Group Asia: which includes Pairs, Azar, and Hakuna (the latter two incorporated as the result of the Hyperconnect acquisition for $1.7B in February 2021).

Emerging & Evergreen: which includes the oldest products like Meetic, OK Cupid, Plenty of Fish, and Match, as well as their latest bets such as Archer, The League, Chispa, and BLK.

While I’m not the biggest fans of consulting matrixes, given the breadth of Match’s portfolio, it is beneficial to try and visualize their respective positioning with the help of a growth-share matrix, as this will prove useful for the remainder of the discussion.

Source: Author’s elaboration

Please note that the purpose of this simple exercise is merely to place each brand within their respective quadrant, rather than to calculate the precise market share and growth rate, which would be a futile exercise for the purpose of this analysis.

Based on the graph, I believe that the biggest questions the market has and that are impacting Match’s valuation, are:

Can Match Group rekindle growth at its flagship cash cow Tinder?

Can the star Hinge sustain such growth and eventually surpass Tinder in terms of cash generation?

Can Match Group transform its emerging brands (which currently represent a question mark) into fresh sources of growth and cash flow? This is especially true considering that the 2021 Hyperconnect acquisition didn’t pan out the way management had hoped, leading to a $217 million impairment of intangibles related to the acquisition in Q2 2022.

Q4 and Full Year 2023 Results

Based on the chart above, Q4 direct revenue results are easy to digest.

Direct revenue was up 10% year-over-year to $851 million, primarily driven by Hinge and Tinder, and partially offset by a slight decline in the other brands.

Match Group Asia and E&E (Evergreen and Emerging) experiences low single-digit declines, Hinge is on its trajectory to become a $1B brand within three years, and Tinder, while still growing, is searching for a direction to rekindle investor’s confidence.

Source: Match Group Q4 2023 Shareholders Letter

Looking at the revenue chart from the past few years, it’s easy to understand why there is so much pressure on Tinder to redefine its direction and find growth beyond low double digits. This is primarily because Hinge alone won't be able to sustain the growth that is expected for the company as a whole. Total top-line revenue growth averaged above 20% between 2019 and 2021, then decreased to just 7% in 2022 and 6% in 2023, despite Hinge recording another year of record growth.

Source: Match Group Q4 2023 Shareholders Letter

While growth is decelerating, the business remains highly profitable and generates positive free cash flow, with its leading position in the market acting as a sort of moat within its operational profile.

Source: Match Group Q4 2023 Shareholders Letter

With regards to margins, there are two aspects that are worth mentioning and that could play a big role going forward with regards to cash generation.

1. Apple recently announced changes to their App Store fee policies in response to the implementation of the Digital Markets Act in the European Union on March 6. In the recent Q4 earning call, Match Group’s CFO anticipated approximately $20 million annualized benefit from this change. For reference, Match Group paid about $650 million to App Stores in 2023 (or about 70% of COGS), so there’s ample room for reduction.

2. Last October, Match and Google reached a settlement in the antitrust case where Match had pursued the right to offer its users an alternative to Google Billing in an effort to avoid Google’s Play Store commissions on in-app purchases. As a part of the agreement, Match said it would implement Google’s new User Choice billing option, which allows app developers to use their own payment systems for a 4% discount (i.e., instead of 15% or 30%, as is standard, developers pay 11% or 26%, respectively.)

This brings tremendous benefits to Match. Based on analysts’ estimates, every 5 points reduction in app store fees represents 10% of EBITDA accretion to Match Group.

On top of this, Match will benefit from a reduction in legal expenses (legal and professional fees declined by $11 million year-over-year last quarter), and most importantly, it will allow top management to regain focus, as Bernard Kim pointed out in the Q4 2023 earning call:

“I feel like we're in a good place with Google, and it really reduces the amount of distractions that we've had as a team, and we can really focus together on growth.”

Source: Q4 2023 earning call

Given these factors, many wonder why a company that sustains healthy margins and still manages to grow 6% year-over-year and 10% quarter-over-quarter (which is quite respectable in my opinion in the current climate) is undergoing such a reset in its valuation. For context, shares reached a peak near $180 in 2021 and are trading at around $34 at the time of writing.

Some analysts suggest that the online dating market, particularly in the United States, appears to be saturated, with user growth plateauing in key apps like Tinder. This leads us to the critical issue and the elephant in the room: Total Addressable Market (TAM) and the number of paying users.

The TAM/payers Conundrum

Though Match Group still beat estimates for fourth-quarter earnings and revenue, its total number of paying customers declined by 5% year-over-year. In the prior quarter, the company had reported a 6% decline in customers paying for its flagship app, Tinder, which sent the stock tumbling.

This is despite its RPP (revenue per payer) increased 17% to $18,67 in the last quarter, which shows how the company is learning how to better monetize its user base.

Source: Match Group Shareholder Letter Q4 2023

Despite the company earning more overall and more per individual payer, the market is uneasy about the overall downturn in payers, as this could signal a decline in overall user numbers and engagement on the platform. If this were the case, it could almost pose an existential question for Match: after all, the success of Tinder and others hinges on the apps maintaining enough user "liquidity" to entice people to sign up, stay engaged, and make purchases through subscriptions and other one-time transactions.

While both U.S. and global daily new users (comprising registrations and reactivations) saw a mid-single-digit decline year-over-year in Q4, influencing payer trends as well, the company does not divulge the total number of active users on the apps or other relevant engagement metrics.

The one simple yet vital question for Match Group is whether the market for dating apps has reached saturation.

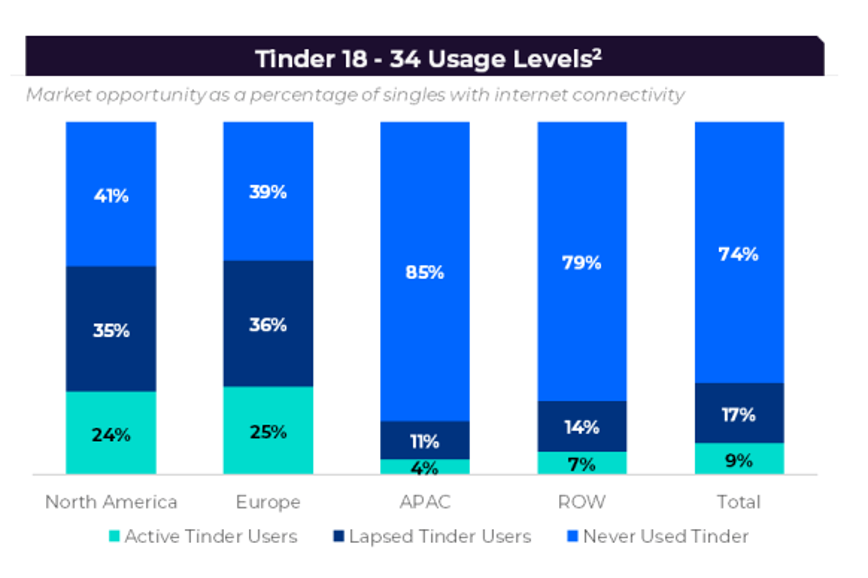

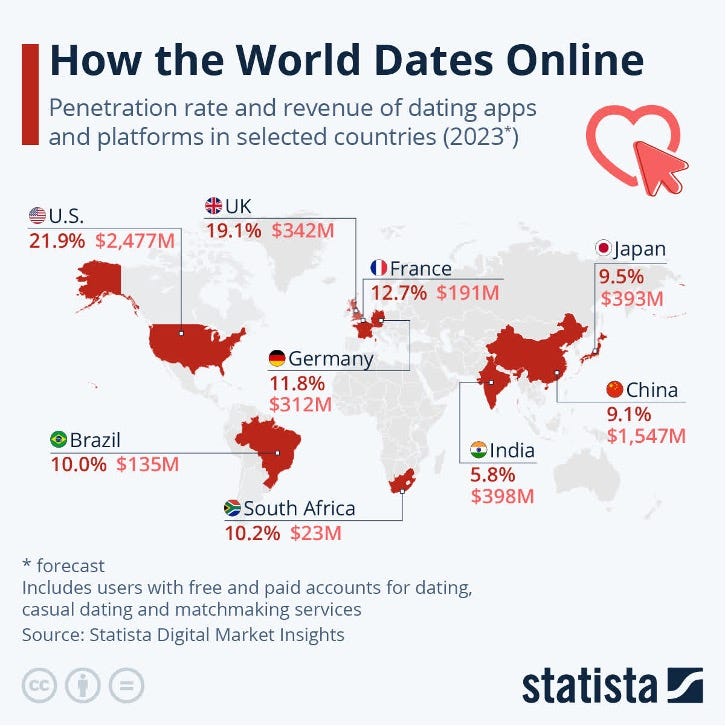

Certain statistics clearly help the narrative that there is still enough room to expand penetration in the dating market. As of Q1 of last year, the company claimed it had not yet penetrated 74% of the global market. This is consistent with Statista’s estimates on the online dating market penetration rate.

Source: Tinder MTCH Shareholders Letter – Q1 2023

Source: How The World Dates Online (Statista)

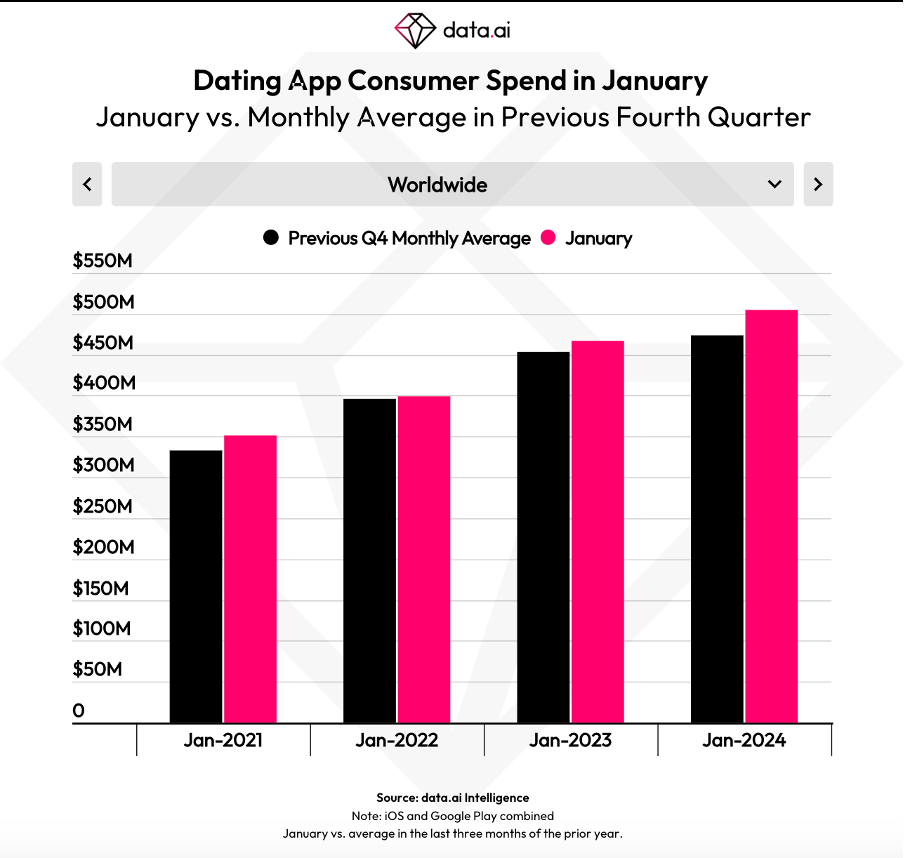

However, more recent reports paint a different picture. According to a new analysis by app intelligence provider data.ai, global downloads of dating apps saw only tepid growth year-over-year as of this January — a slight increase of just 1.9% to reach 128 million installs, compared to the 29% increase seen during the same period in the previous year.

Source: data.ai (fka App Annie)

The same report, consistent with Math Group’s results, shows how worldwide dating app revenue has increased ca. 10% in the past year.

Source: data.ai (fka App Annie)

At the same time, while only three in 10 adults reported ever using a dating site or app in 2023, this figure has remained unchanged since 2019, according to Pew Research.

This may have prompted analysts to speculate that the stagnation of this ratio is evidence that the market is more saturated that one might think.

In my opinion, this fixation on the number of payers stems from the narrative of the past decade, which has equated constant user growth with the success of a growth stock. However, without realizing that Tinder, or Match Group as a whole, is no longer a startup, but rather a company at a more mature stage of its lifecycle. Therefore, it is only natural that user growth might not be the sole driver of value creation at this stage.

Analysts seem unable to come to terms with the fact that Tinder is simply at a different point in its lifecycle. It is a cash cow that is learning how to monetize its user base more effectively but will inevitably not grow its user base as fast as it did in the past.

Moreover, they overlook that Hinge is on a path to become as significant as Tinder, with a higher RPP and payers consistently growing at over 30% and revenue at 50% in 4Q23 (an acceleration from 44.2% in 3Q23). Match's apps are at varied stages of their lifecycle, and to believe that a 12-year-old app like Tinder could be the sole value driver is simply delusional.

Analysts are questioning how long higher pricing can be sustained. In the past three quarters, Tinder has witnessed its steepest price increases (nearly 50% y/y cumulatively), and some argue that continual price hikes are unsustainable, as they could further erode the user base.

Yet, management has expressed confidence in their growth strategy, and the CFO has consistently stated that their focus is on top-line growth, not the number of payers. They have repeatedly emphasized that in some years the product roadmap may lean more towards payer growth, while in others, it may concentrate on RPP growth.

In the Q4 2023 earning call, CFO Gary Swidler said:

“As we've talked about many times, we're focused on increasing revenue, not specifically increasing revenue per payer or payers just for the sake of moving either of those KPIs.”

The same had already been clearly stated during the Q3 2024 earning call:

“I think this is probably my 32nd earnings call and probably on all 31 that have come before this one, I've talked about how the company focuses on revenue growth, not specifically on payer growth or revenue per payer growth. And our goal is to drive sustainable, strong revenue growth through a combination of payer growth and RPP growth. And in some years, the product roadmap tends to be more heavily focused on payer growth. And in some years, the product roadmap tends to be more focused on RPP growth and we're somewhat agnostic.”

Management anticipates a modest improvement in Tinder user trends over 2024 but does not expect a return to year-over-year user growth. They predict that payer growth will recover throughout the year, achieving positive sequential payer net additions in Q3 and positive year-over-year payer growth by Q4.

The methods to achieve this were not made clear in the earnings call. Management cited marketing as one of the drivers (which is always uncertain since the return on marketing investments is unpredictable) as well as other product initiatives focusing on dynamic pricing, monetization/conversion strategies, and investments in AI to enhance user experience.

Product Innovation

A de facto duopoly that is hard to break into

The current dating app market operates as a de facto duopoly, with Match Group and Bumble collectively wielding control over close to 70% of the market share.

While there are some other smaller players that successfully target specific (ex. Raya, the dating app for the ‘supposedly’ famous) and carve out some market share, scaling is an arduous task for any newcomer.

Some years ago, a16z investor Andrew Chen published a blog post titled ‘Why investors don’t fund dating,’ in which he states that “the reality is that securing funding for a dating product from mainstream venture capital investors is incredibly challenging. A significant portion of angels and funds categorically refuse to invest in the dating category, similarly to how many avoid the gaming, hardware, gambling, etc., sectors.” He then lists a number of reasons, such as:

the built-in churn inherent in such products (the better your dating product works, the more your customers will churn and every churned customer is a new customer you’ll have to acquire just to get back to even);

the fact that paid acquisition channels (CAC) and city-by-city expansion are expensive;

and the stigma that effectively limits virality (dating apps aren’t social in the same way Facebook or TikTok are i.e. your friends aren’t naturally inclined to sign up on Tinder and then invite you to join the app).

Ultimately, the few dating products that demonstrate promising metrics, like Hinge and The League, tend to be swiftly acquired by Match Group. After all, founders recognize the difficulty of scaling, even with a successful product, and often find it more attractive to continue growth withing a larger company, while cashing out after years of grind.

“Ok but what about other social apps?” some may ask. Platforms like TikTok and others are not venturing into dating. They are simply not built with that layer of privacy that is critical in dating apps. And it’s worth noting, Facebook’s foray into dating was a massive failure.

The bottom line is that Match Group is the market leader in a de facto duopoly, and it is still managing to grow at 10% year-over-year in a challenging economic climate. In my opinion, this resilience is one of the company’s most compelling attributes.

However, while the nature of the dating industry means that early movers like Match Group have cemented a competitive position that is difficult to undermine, the risk of operating in a de facto duopoly is the potential to become complacent regarding what people truly desire.

Innovation roadmap remains unclear, although there are untapped opportunities

As mentioned earlier, the specifics of the innovation roadmap were not clearly outlined in the most recent earnings call, though management provided some insights into three macro-areas of focus.

One area is improving the experience and catering better to women and Gen Z. The second focus area is the development of new AI-centric products, as management believes AI can enhance user experiences and attract those previously resistant to the category, as well as potentially expand the TAM. The company anticipates an incremental AI-related expenditure of $20 million to $30 million across Match Group in 2024.

While AI's potential for increasing workflow productivity within the firm is undeniable, I believe, at this stage, AI is more of a buzzword used in earnings calls to placate analysts rather than a concrete solution for enhancing user experience.

The third focus area is Hinge, with management confident that it can become a $1 billion top-line business through a mix of product innovations and market expansions. To support its growth, management plans to invest an additional $40 million to $50 million in Hinge's product and marketing in 2024 compared to 2023.

Overall, product development costs, including SBC (Share-Based Compensation) expense, rose by 21% year-over-year in Q4, primarily due to higher compensation expenses from an increased headcount at Hinge and Tinder. These costs accounted for 11% of total revenue, a 1 percentage point increase from the previous year. This indicates significant investment in the talent expected to drive this innovation.

Beyond the three areas highlighted in the earnings call, I believe there are two other trends not mentioned that the company should focus on.

1. Meeting people in real life

Having more options, both in terms of apps and potential mates, is not necessarily synonymous with a better experience. In fact, in the past few years, dating app fatigue has emerged as a significant trend players like Match Group must address if they wish to rejuvenate engagement. In a 2023 survey from the Pew Research Center, 46% of Americans reported their overall experience with online dating as negative, up from 42% in Pew's 2019 survey on the subject, while just over half of women reported a negative experience. Having nearly endless options can result in decision fatigue and greater doubt about the chosen match.

Meeting people in person in becoming an enticing option for those experiencing app fatigue. And some companies are capitalizing on this trend by building products that serve as facilitators for making connections outside the app. For instance, London-based startup Thursday markets itself as the ‘offline dating app.’ The app is available only on Thursday; when the clock strikes midnight, users toggle an icon to indicate that they’re ready to date that day. For the next 24 hours, they can swipe and chat as on other dating apps. However, when Thursday becomes Friday, their matches disappear and the app locks until next Thursday. The implication is that there’s no time to waste with chitchat. They also organise members-only, IRL events/mixers where people can connect.

Similarly, Los Angeles-based 222 operates in a similar fashion, but with a focus on friendship and connection rather then dating. They created a marketplace between hyperlocal venues and members looking to discover their city and meet new people through unique social experiences.

While scalability remains a question for these two examples, there is an unquestionable appeal about connecting offline, rather than through a screen. I believe Match could benefit from incorporating features or even developing dedicated apps that replicate some of these mechanics, thus providing an alternative to traditional app-based dating.

2. Boomers have joined the chat

While it might sound like a bold statement, it is not unfounded to believe that thanks to dating apps, people might reconsider how they view relationships. If there is a pool of potential mates that is more accessible thanks to dating apps, people will not resign themselves to being in just any relationship for the sake of finding companionship. Knowing that there are alternatives out there, and that the barrier to getting to know those potential alternatives is lower than it would be in real life, they will compromise less and enter into relationships more often than what was the standard norm.

The demand for senior dating services, from local mixers to age-specific apps, is higher than ever in a rapidly aging America. By 2030, there will be more residents over 65 than under 18 for the first time. According to Pew Research, 30% of Americans over 50 are single; for people over 65, it rises to 36%. Many of them are romantic as ever, hopeful to find love in whatever season of life it finds them.

In my opinion, tapping into older demographics with tailored products can represent a big growth opportunity for Match Group for several reasons. Longer lifespans have given older singles the opportunity to have new, long-term relationships. Moreover, they are more technologically savvy, have time to meet new people, and most importantly, possess the financial means to pay for pricy subscriptions.

Source: Pew Research Center (data from a 2019 survey)

While some may argue that Match Group taps into this demographic with its older apps (like Meetic or Match), I believe that those products are not designed with the contemporary dynamics and expectations of older segments in mind. These age groups look for a dating product that aligns with their specific needs, expectations, and ways of interacting with technology and digital interfaces, and I believe that there is still a lot of innovation that can happen with regards to these aspects.

Management shakeup and Elliot stake

When you command close to 70% of the dating app market, it’s easy to get complacent when it comes to innovation – a situation I believe Meta faced in 2022 and, to some extent, Google in the past few years. But I digress.

I believe this complacency is what prompted the board to appoint Bernard Kim as the new CEO in May 2022. He took over with a mandate to re-energize growth and reinvigorate earnings momentum. That corporate overhaul has extended into 2023 with a new organizational structure aimed at enhancing efficiency, streamlining operations, and focusing on new business opportunities.

While it’s premature to evaluate the outcomes of management’s efforts fully, I think credit is due to Kim, who deserves the benefit of the doubt: after all, in less than two years, he has restructured the team and steered the company back to top-line growth. Achieving a 10% year-over-year growth in this challenging environment, while undergoing comprehensive organizational restructuring, is no small feat.

Moreover, in August 2022, Bernard Kim invested $1 million of his own money into the company, at a share price of $64. Although he will earn significantly more than this through stock-based compensation over time as CEO, such a move signals strong commitment. Today, with the stock down nearly 50% from his purchase price, it's evident that he is significantly underwater, emphasizing his belief in the company's future prospects.

Elliot

On Jan 8 of this year, activist invest Elliot disclosed it had accumulated a $1 billion stake in the company. At an average price of $37.84, this is equivalent to 10% of Match Group’s market cap, a significant stake to own in any company.

Elliott is one of the largest activist investor firms in the world and specializes in turning around companies (and, most often than not, making a good profit from them). Big winners in recent years have been Marathon Petroleum Corporation (MPC), with an average price in the $40s and is now up more than 319% at the time of writing, and Peabody Energy Corp, which has an average purchase price of close to $5, and trading at $27.16 at the time of writing.

While no significant actions have been publicly announced yet, Elliott's substantial investment strongly suggests that the firm is confident in its ability to collaborate with Match Group’s management to enhance shareholder value.

Capital allocation

Marketing spend remains too high

Selling and marketing costs, including SBC expense, increased $32 million or 25% year-over-year in Q4 2023, primarily due to increased spend at Tinder. Selling and marketing spend was up 2 points as a percentage of total revenue at 18%.

This is not expected to stop, as noted by management in the last earning call:

“We expect overall Q1 marketing spend to increase by approximately $30 million year-over-year collectively at Tinder and at Hinge compared to the levels these brands were spending at in early 2023 as we seek to reinvigorate user growth at Tinder and continue the stellar user growth at Hinge in both core and European expansion markets during our peak season in the first quarter.”

Source: Match Group Q4 2023 Earning Call

What makes me nervous about marketing spend is that it seems like the company is still too reliant on it to sustain user growth: during the Q3 2023 earning call management discussed how in late summer of last year Tinder pulled back its spend on the campaign and saw an overall down trend in users as a result of the marketing pullback.

During the last earning call, an analysts asked about what caused Tinder user growth to be negative despite the incremental marketing spend.

In the last earning call, CFO Gary Swidler stated that “when you try to put in place a brand narrative and start to tell that story, it takes time to build.”

While I agree with the premise in theory, the numbers indicate that the company remains overly reliant on marketing expenditures. After all these years in business, the continued dependence on marketing to construct the appropriate brand narrative is concerning.

Debt level

Match holds $575 million of convertible notes due in 3 years. Even if Match were to refinance its convertibles, it is very likely that interest on the 2026 convertible will be substantially higher than 0.875%. This is not only due to the general higher level of interest rates in the economy, but also that Match's revenue growth rates are slowing, meaning that creditors will require a more alluring coupon to part with their capital.

Source: Q1 2023 shareholder letter

Looking at Match Group’s net leverage ratio, we can see that the ratio has decreased to 2.4x at the end of Q4 2023 after stalling around 3x for the previous three years.

Source: Author’s elaboration

Match group defines its leverage ratio as total long-term debt divided by adjusted operating income. The latter is a non-GAAP metric, and the company defines it as operating income plus stock-based compensation expense, depreciation, and impairment and amortization of intangibles. If we remove these three components and consider the operating income as the denominator, the ratio increases from 2.4x to 3.1x.

Considering that as of December 31, 2024, Match Group had $869 million in cash and cash equivalents on the balance sheet, the debt level seems manageable. However, it would be even better if they could use their cash to reduce debt rather than buy back shares to counter the increasing number of stock-based compensation.

Stock-based compensation is a concern

A good primer on SBC can be found here.

In 2022 and 2023 Match Group repurchased 13.5 million and 7.2 million shares of common stock, respectively, for aggregate consideration, on a trade date basis, of $546.2 million and $482.0 million, respectively. Based on these numbers, the average share price paid was ca. $40 in 2022 and $67 in 2023.

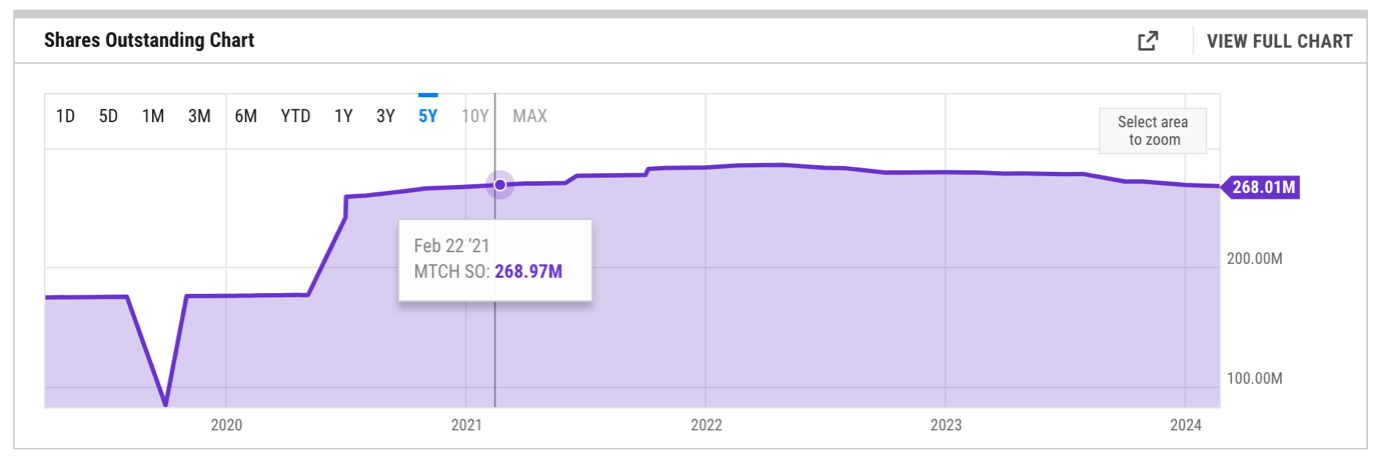

And yet, despite deploying these considerable sums to repurchase shares, its share count has been basically flat in the past three years.

Source: ycharts.com

Basically, they use buybacks to counter SBC and offset shareholder dilution rather than return money to shareholders.

Stock-based compensation as percentage of revenue has increased from 4.9% in 2021, to 6.4% in 2022 and to 6.9% in 2023. While this is not outrageously high (for context, Palantir’s SBC/Revenue is equal to roughly 50%, Crowdstrike’s is equal to 21.3% and Atlassion is equal to 18.5%) the average for Apple, Microsoft, Alphabet and Amazon is ca. 3.6% (at the time of writing).

What is more worrying, is what management states in their most recent 10-K:

“In the past we have had, and may continue to have for the foreseeable future, significant amounts of stock-based compensation expense due to the competitive market for executive and technical talent, which includes competitors that are much larger than us.”

In other words, it’s expensive to attract talent.

On January 30, 2024, the board of directors of the company approved a new share repurchase program of up to $1 billion in aggregate value of shares. However, it is still unknown what Elliott's plans are and whether they will impact this plan.

Buybacks and M&A

In the Q4 2023 shareholder letter, management notes that the board “has authorized a new $1 billion share repurchase program and is committed to returning at least half of the company’s free cash flow in 2024.”

Analysts expect Match Group to generate ca. $1 billion in free cash flow in 2024, and the company expects stock-based compensation to increase to $275/285 million (up from $232 in 2023). This means that a large portion of the $500 million in free cash flow that the company is expected to return to shareholders in 2024 will be effectively used to counter the dilutive effect of stock-based compensation.

With regards to M&A, in May 2023 management stated that they intended to use the remainder of free cash flow first to invest in the business, but also to maintain financial flexibility to pursue opportunistic M&A as a second use of free cash flow. Back then, management was clear that those acquisitions would have to be adjacent and consistent with the company’s stated mission, and if those compelling acquisition opportunities couldn’t be found, then they would expect to return the remaining excess capital to shareholders.

In the last shareholder letter management stated that they are funding significant investments in growth through the income statement and that they don’t have any intention of acquisitions in the near term given the strategic and operational focus. As a result, they expect capital return levels in 2024 to exceed the targeted minimum of 50%.

I personally appreciate this statement by management, as it shows that they don’t want to grow revenue at all costs and that are focused on driving operational and product efficiencies internally. While it might take more time to achieve growth organically, I believe this shows confidence from management that they have the skills, assets and talents that can deliver on what the market expects.

While management has not specifically mentioned the introduction of a dividend, I believe that the recent announcement by Meta might shift the narrative for all growth stocks about how they think about this form of capital allocation.

Given Math Group’s large cash generation, and assuming they will be able to bring the debt further down, I don’t think the introduction of a dividend is totally out of the question in the coming years.

Valuation

For the full year 2024, management expects Match Group to deliver total revenue of $3,565 to $3,665 million, representing Y/Y growth of 6% to 9%. Tinder is expected to grow top line by 6% to 8%. Across other brands, they expect top line to grow by 6% to 10%, with Hinge reaching revenue of $535 million to $545 million, representing Y/Y growth of 35% to 37%.

As mentioned previously, we can look at 2024 as still another transition year where much of the narrative is on operating a turnaround that should translate into top line growth.

This means that there are still many unknowns in terms of how the product initiatives will impact growth, as well as how marketing spend will translate into positive returns.

I believe this uncertainty is keeping the price below its fair value.

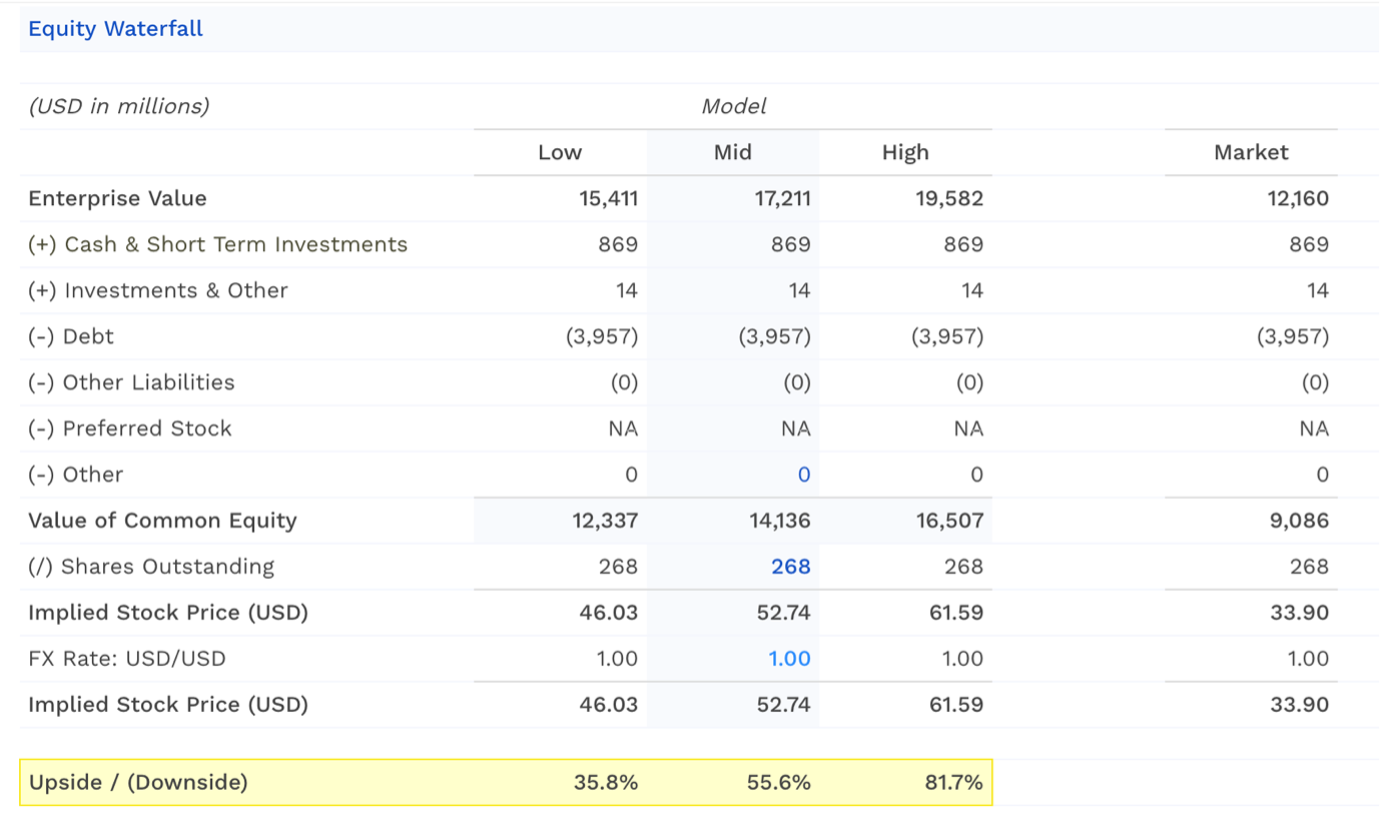

I used Finbox valuation tools to help us get a sense of a fair value based on analyst projections.

Here’s a quick summary of the model (which you can also explore here):

Finbox.com

The table below shows projected free cash flows to the firm. These are cash flows available to both debt and equity stakeholders. The model assumes that Match Group will generate over $1 billion of FCF next year.

Finbox.com

Now, Match Group has $869M of cash in the bank and nearly $4B in debt, so we need to translate the fair value of the entire enterprise to the fair value of a single share of equity. The table below shows the calculations.

Finbox.com

Note: Finbox is using only the number of shares of common stock outstanding as of February 21, 2024, which is equal to ca. 268 million shares, as opposed to the total diluted shares outstanding, which is equal to ca. 280 million, as per latest letter to shareholders. There is a long debate with regards to what number is more correct to use. If you are interested in the topic, you can read more about this debate here and here. I do believe that for companies where SBC is a key expense item, like for Match Group, the more conservative approach of including the fully diluted share count is sounder, or at least it is something to include when coming to such considerations as share price. If we substitute 268 with 280 in the calculation above, the range goes from $46.03-$61.59 to $46.01-$58.68.

The low-end of the range of the model returns a $46.03 stock price. Considering the current price of $33.24, at the time of writing, Match seems to be undervalued.

You can see the full DCF model here (please note that the numbers will likely be slightly different from the ones you see above based on when you read this article).

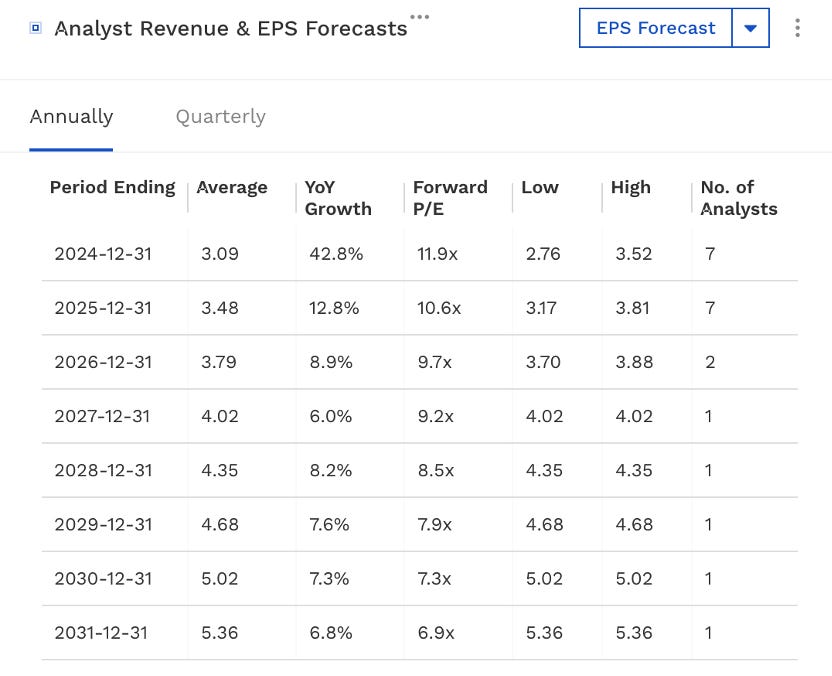

Aside from the DCF model, which is an exercise that can lead to different results based on how the assumptions are built, let’s look at earning multiples. Analysts estimate that Match Group will generate $3.09 per share in earnings this year and $3.48 next year. This equates to a 2024 and 2025 price-to-earnings ratio of 11.9x and 10.6x, respectively.

Finbox.com

Looking at comparable companies is not a straightforward exercise, given how consolidated the industry is and the fact that there are only two publicly listed direct competitors: Bumble and Spark Networks, the latter headquartered in Berlin, Germany and which operates lesser-known dating sites such as Zoosk, EliteSingles, among others.

Bumble currently trades at 18.2x 2024 P/E, whereas Spark Networks is still unprofitable and undergoing a restructuring after filing for bankruptcy last year (my bet is that Zoosk, the most popular of its brands, will be acquired by Match Group this year).

Meta trades at a 24.2x 2024 P/E, whereas Pinterest and Snap at 25.4x and 66.4x respectively.

Finally, average analyst estimates indicate a target price of $44.7, representing a 31.2% potential upside.

Source: Market Screener

Conclusion

Valuations are inherently subjected to many variables, biases, and opinions. Therefore, my goal is not to pinpoint a specific price target, but rather to address the question: how confident am I that the current stock price is undervalued?

While love and dating is often considered recession-proof, in the event of a recession, users can certainly cut back on dating apps subscriptions or downgrade to less premium tiers. Coupled with the increased cost of going on a date given the rising inflation over the past few years, this could impact the growth of dating apps growth, including Match’s.

Nevertheless, I find it hard to believe that Match Group will remain at a $9B market cap for long.

I believe the social trends diminishing the stigma around online dating (especially among older demographics), its status as the market leader in a de facto duopoly, and having a management team with experience in monetizing digital products are all factors that should work in its favor.

While I have reservations about how the company is managing its capital allocation, particularly concerning the use of cash for share buybacks to offset increasing stock-based compensation instead of reducing debt or potentially introducing a dividend, I believe Elliott's activist presence on the board will serve as a positive catalyst. This influence should guide management towards a disciplined yet shareholder-friendly approach to capital allocation.

Considering all these factors, at the current price, I would confidently rate the stock as a buy.

I welcome open debate and encourage criticism, especially well-reasoned pushback. If you disagree with any points or wish to enrich the discussion, please share your thoughts in the comment section.

Disclosure: I have a beneficial long position in the shares of MTCH either through stock ownership, options, or other derivatives.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it and I have no business relationship with Match Group.

This is not financial advice. Do you own due diligence.

Incredibly insightful!