D2C and Retail Tech: Some Thoughts for 2020

The Big Idea

The way people shop for consumer products is undergoing a tremendous change which will influence how products are conceptualized, marketed and delivered to customers.

As a consequence, more innovation in last-mile delivery and management of customer returns will be necessary to meet the increase in e-commerce adoption.

Moreover, this will impact how stores are conceived, and the concept of retail as we know it today will inevitably be morphed to allow for enhanced experiences.

This thesis is predicated on 5 assertions:

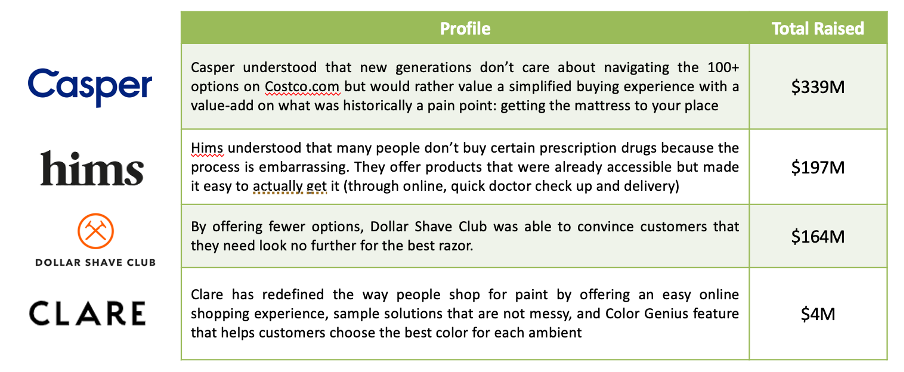

Successful D2C start-ups simplify the decision-making process i.e., offering a product that is good enough while delivering incredible customer experience.

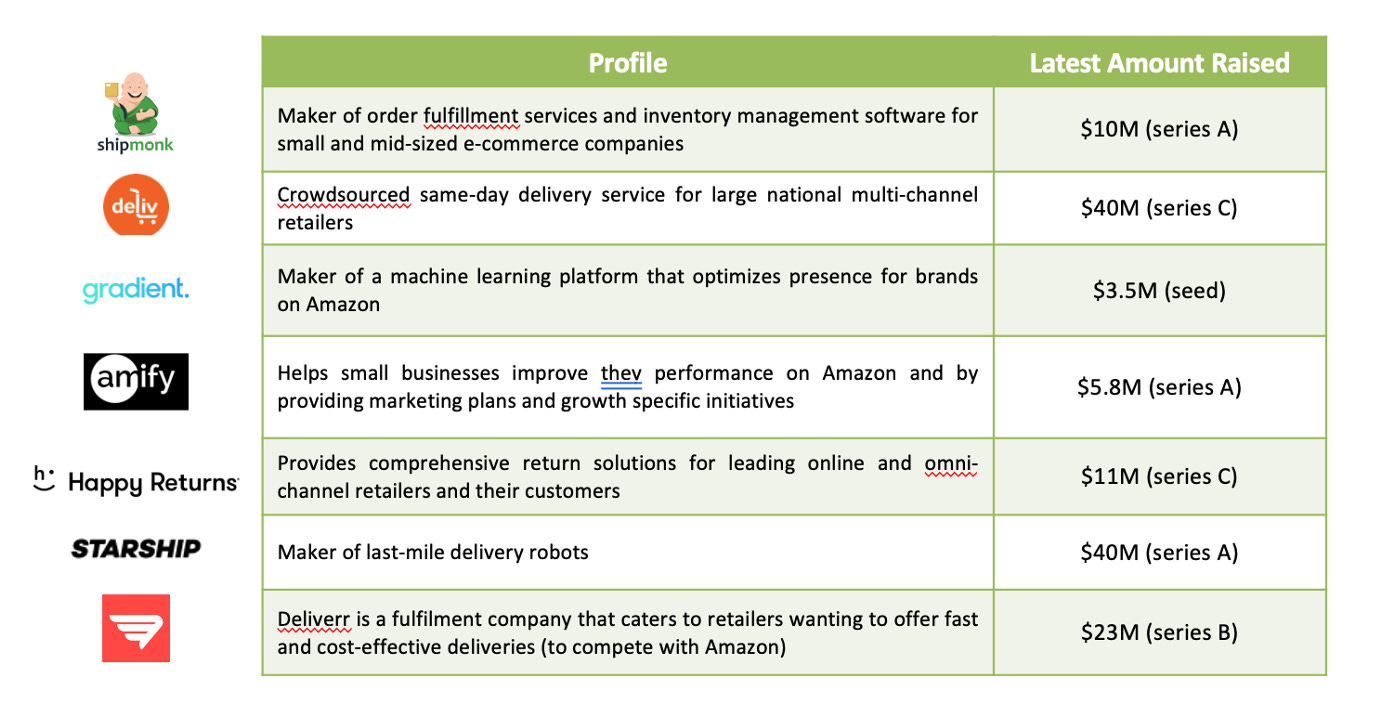

This is inevitably creating a need for innovation in everything that goes around delivering these products: last-mile delivery, returns and solutions for start-ups/SMBs selling online will drive the next wave of innovation in e-commerce.

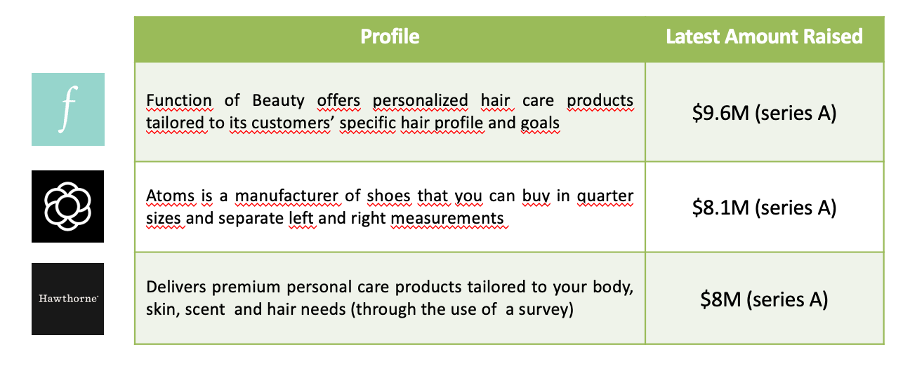

Digitally native start-ups that are able to introduce/change their products at a faster pace thanks to readily available customer data are acquisition targets by major corporations. Their flexibility also allows them to introduce personalized products.

All this will have an impact on the retail industry. Traditional brick and mortar is not dead, but retail tech startups will redefine the way we experience shopping.

Although Gen Z doesn’t shop at malls anymore, they are still looking to engage with online-native brands in a physical setting.

1. Millennials and Gen Z don't want to choose: successful brands will simplify the purchasing decision process while delivering a great customer experience

• Simple products: Successful D2C companies for the most part approach quality from an entirely different direction. Rather than catering to different levels of interest and motivation — here’s a cheaper bed with [X, Y] features and a more expensive one with [X, Y, Z] features — they cater to the desire for simplicity. They cater to the desire to avoid choosing, and the desire for something that is just fine.

• Enhanced experience: These companies aren’t necessarily raising the bar on quality or selection. They’re raising the bar on the customer experience. They’re delivering a far better razor buying process and a better mattress buying experience. Their products may be just good enough in most cases. The end-to-end user experience, however, is so much better that it elevates them above their traditional competitors.

2. This is inevitably creating a need for innovation in everything that goes around delivering these products: last-mile delivery, returns and solutions for start-ups and SMBs selling online will drive the next wave of innovation in e-commerce.

• The US postal system is going through some turbulent times, running almost at full capacity and with no ready solution to face the increase in e-commerce shopping projected for the coming years.

• Last-mile delivery innovations will attract most investments as it is the most complicated and costly part of delivering a product.

• Customer returns are one of the main lines in the P&L of many e-commerce companies; finding solutions to better handle them and reduce the impact on the cost part of the P&L will be key.

• With the increase of D2C start-ups, these companies will need solutions to manage their business effectively and without investing huge amounts of money in infrastructure.

3. Digitally native start-ups have the flexibility to respond to market changes faster than corporates while collecting vast amounts of shopping data, which allows them to better roll out personalized products/solutions

• Fast go-to-market: It takes about 6-12 months for multinationals to develop and launch a new product. Digitally native start-ups, on the contrary, can keep pace with a market that craves newness and innovation at the speed of Instagram, staying continuously present in the hearts, minds and social media feeds of consumers. Corporates are looking for digitally native brands with social media savvy.

• Customer data: Data on consumer preferences, shopper purchasing patterns, and more is invaluable to corporates, which are becoming increasingly data-driven. Whether through personalization initiatives or beauty AR platforms, startups have found new ways to capture compelling consumer data that corporates could benefit from.

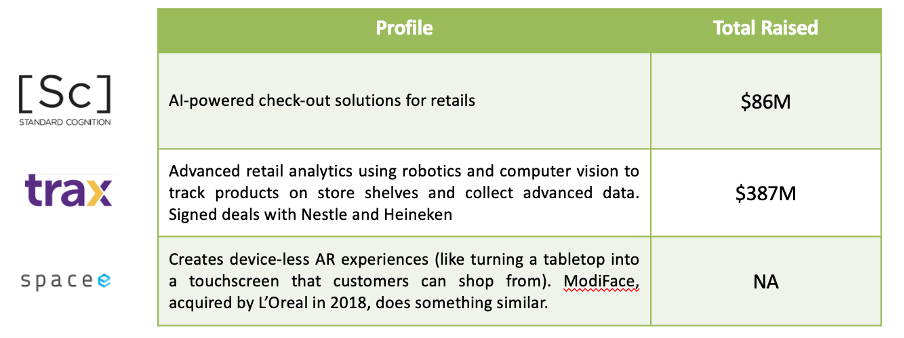

4. Brick and mortar is not dead, but retail tech start-ups will redefine the way we shop.

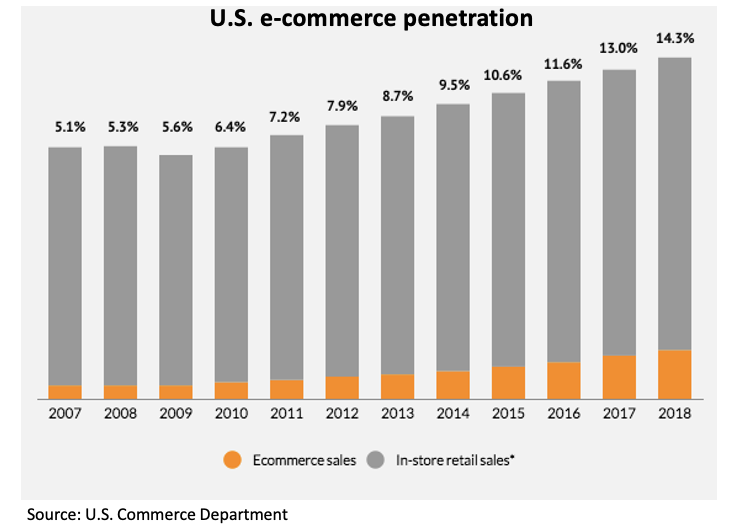

• As impactful as e-commerce has been, it still represents less than 15% of U.S. retail sales. While e-commerce dominates certain sectors (ex. books), it has effectively failed to penetrate other markets (ex. groceries). E-commerce is a force and is undoubtedly transforming retail. However, brick and mortar isn’t going anywhere soon, and retail tech companies are leveraging this popularity to build new, transformative products.

• Retail tech is a booming industry and one which will keep retail alive in the coming years. The ways companies are changing the retail experience will play a key role with regard to survival rate among retail-first brands.

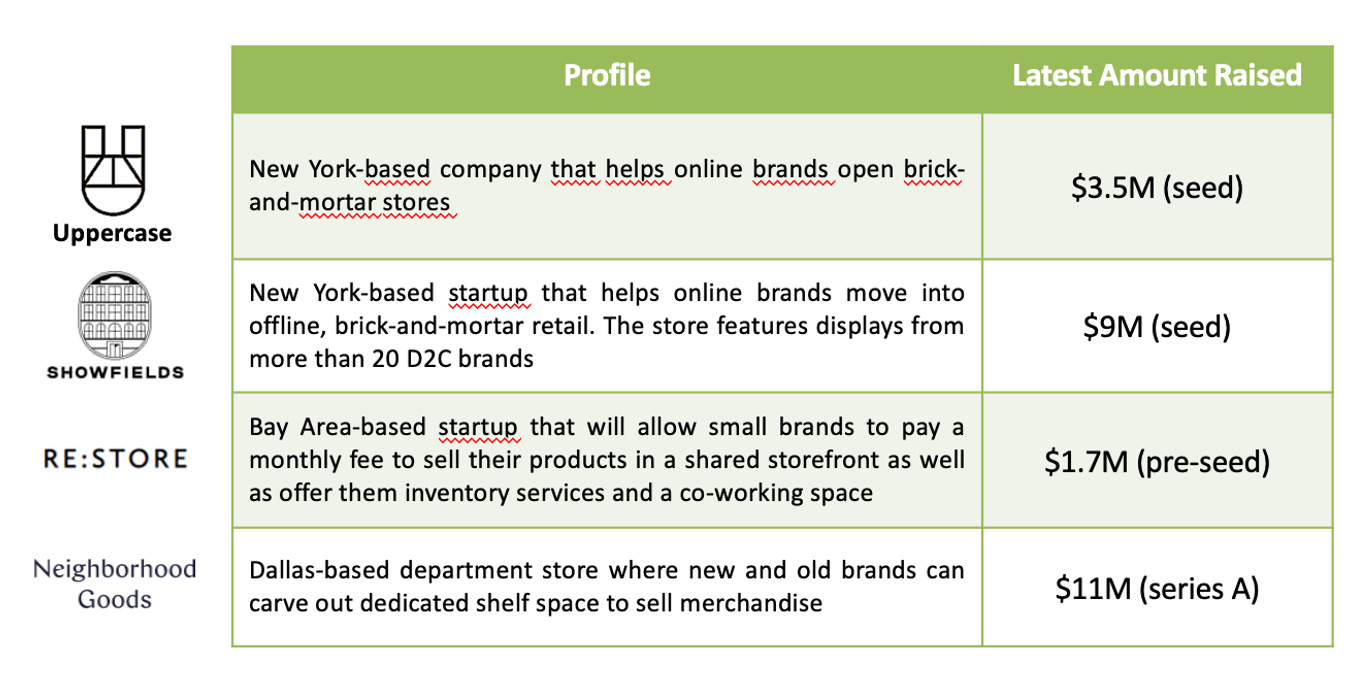

5. Although Gen Z doesn’t shop at malls anymore, they are still looking to engage with online-native brands in a physical setting.

• Experiential retail: Many D2C brands are introducing a physical retail component or blend online and offline retail channels to better connect with their audience. And many start-ups are proposing solutions to do just that.